Mayor Voices ‘Concern’ Over Insurance Rules that Hurt City Residents Injured by Uber, Lyft

Mayor de Blasio on Wednesday expressed “concern” about a disparity in insurance requirements for Uber and Lyft taxis — revealed Monday in a Streetsblog investigation — that hurts city crash victims, and he promised to review the issue further.

“It does raise a concern for me, and we will get you an answer on this,” de Blasio said on Wednesday when asked about the insurance disparity, which provides far less compensation for people injured by Uber and Lyft drivers in New York City than elsewhere in the state, even though the risk of getting hit by a car is much higher in the city.

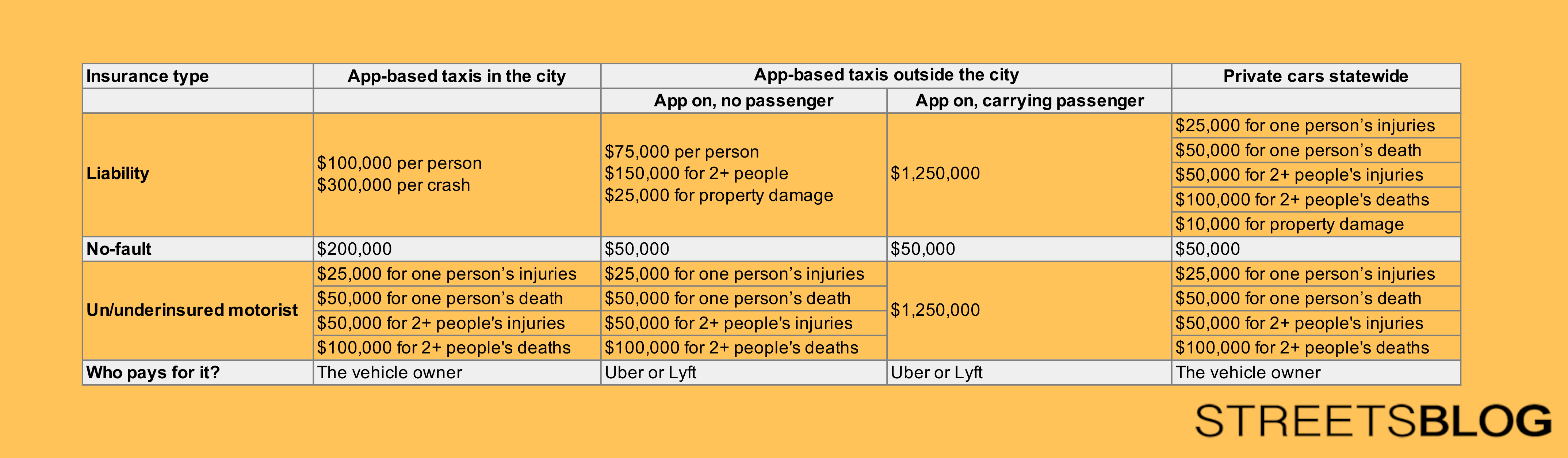

New York State requires Uber and Lyft taxis to have $1.25 million in liability insurance – meant to compensate crash victims for their losses – when drivers accept trip requests or have passengers. But the state exempts New York City from that requirement. Instead, the city’s Taxi & Limousine Commission requires for-hire vehicles, including Uber and Lyft cars, to carry only $100,000 in liability insurance person, a sum that attorneys say often fails to match the true cost of crash victims’ injuries.

The city hasn’t raised that minimum insurance requirement for for-hire vehicles in two decades, even as the cost of medical care has skyrocketed and some 80,000 app-based taxi drivers have inundated city streets. Asked Friday whether the city should increase that TLC requirement, de Blasio demurred, promising to comment further at a later date.

“There’s a logic to what you’re saying, I’m seeing it right away,” he said. “Obviously aligning to Vision Zero, which has been a foundational philosophy of this administration, we have to recognize all the things we need to do to keep people safe and also create an awareness of the need for people to drive differently. And I do think these economic factors play into that. So I’m going to look into this quickly.”

The mayor was one of a handful of elected leaders and activists who responded quickly to Streetsblog’s investigation with similar expressions of concern.

A spokesman for Gov. Hochul said road safety should be a top priority and that her office was reviewing the gap in insurance requirements.

State Sen. Neil Breslin (D-Albany), who chairs the Senate Insurance Committee, promised to examine the topic, too.

“If there is a disparity between minimum insurance limits for passengers in New York City as compared to the rest of the State, that is certainly an issue the Insurance Committee will take a closer look at to determine if changes need to be made,” he said in a statement.

And Sen. John Liu (D-Queens), a former insurance actuary and a member of the Senate Transportation Committee, said he is considering legislation on the issue.

“Insurance requirements should properly reflect frequency and magnitude of risk and therefore it seems inconsistent that the minimum required in NYC is less than the rest of the state. Once again, Uber is putting passengers and the public at more risk – in the same way they have always pushed traditional employer costs onto the public – by claiming that their drivers are independent contractors,” Liu said in a statement. “We are looking into the issue and contemplating legislation to provide adequate protection to riders and the public.”

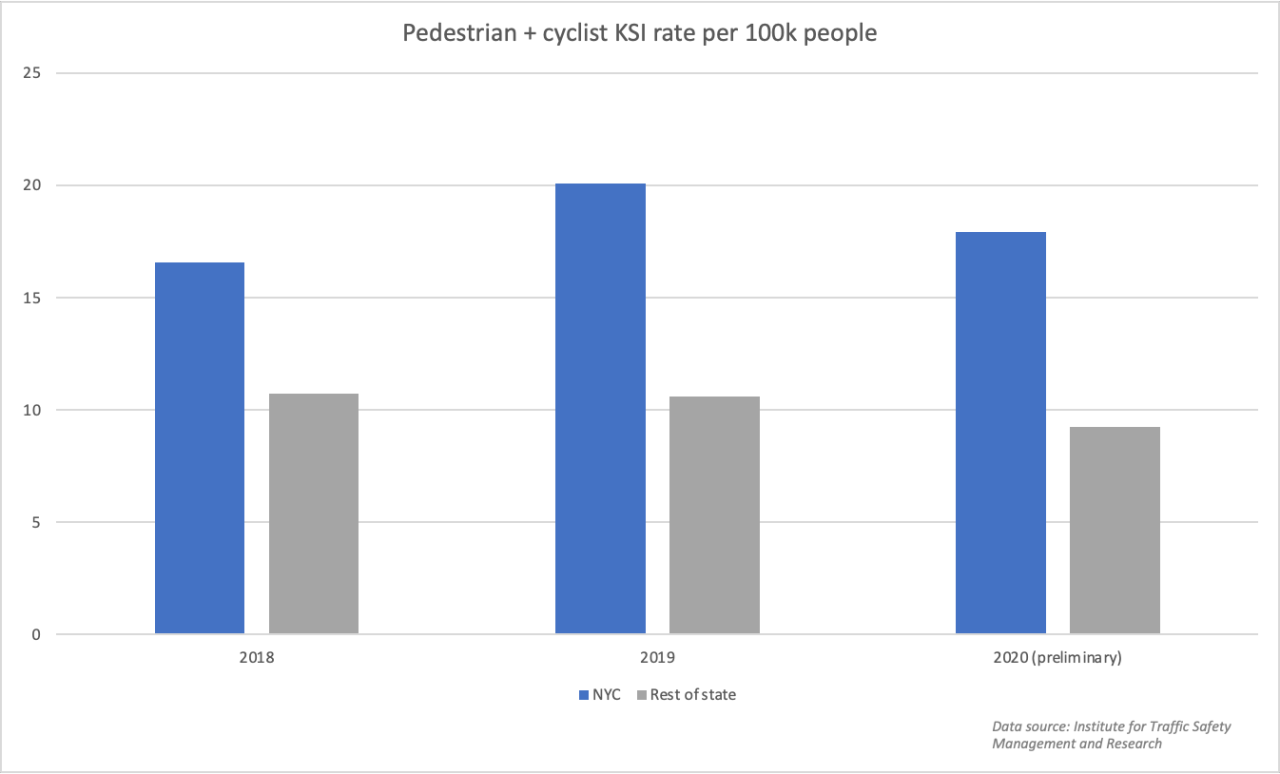

Pedestrians and cyclists are twice as likely to be killed or seriously injured by a car in the city than elsewhere in the state, according to a Streetsblog analysis of data from the U.S. Census Bureau and the Albany-based Institute for Traffic Safety Management and Research. And thousands of “black cars” — the TLC category that includes Uber and Lyft taxis — get into crashes involving injuries each year, city data shows.

Uber told Streetsblog that the insurance disparity is smaller than it seems, as the company carries $1 million in extra liability insurance per trip in the city. But the tech giants argue in court that drivers on their apps are independent contractors, not employees, and therefore the companies aren’t liable for injuries they’ve caused.

The companies seemingly always settle before going to trial when a seriously injured plaintiff brings a credible suit, according to attorneys who’ve represented crash victims in suits against Uber and Lyft. Those settlements come with strict non-disclosure agreements, obscuring how much financial responsibility the multi-billion-dollar firms take for crash injuries.

Many defended the TLC’s regulations to Streetsblog, noting the agency has stiffer requirements for app-based taxis than many other cities. In a statement, TLC Commissioner and Chair Aloysee Heredia Jarmoszuk noted the agency’s insurance requirements exceed the state minimums and that the TLC requires for-hire vehicles and their drivers to be licensed by the agency.

Street safety advocates also expressed dismay about the disparate insurance requirements.

“This policy is unfair and shortchanges New Yorkers when they need help most,” said Marco Conner DiAquoi, deputy director of Transportation Alternatives. “Victims and their loved ones know all too well the immense physical, emotional, and financial toll of traffic crashes. Crash victims in the five boroughs deserve protection and support that they would get elsewhere in New York State.”

DiAquoi called on city leaders to do more to redesign dangerous roads to prevent crashes before they happen, and pressed lawmakers in Albany to pass a package of bills aimed at making streets safer in the city and statewide.

Leah Golby, board president of the New York Bicycling Coalition, called the disparity “not O.K.,” saying pedestrians, cyclists and others using public right-of-ways deserve the same safeguards in New York City as in the rest of state.

“Whether you’re in one of the five boroughs, on Long Island, Buffalo or the Adirondacks – it doesn’t matter,” she said. “Everybody needs the same protection.”

The city also requires cars on the Uber and Lyft platforms to carry $200,000 in “personal injury protection,” also called “no-fault” insurance, which is more than the $50,000 required in the rest of the state. But no-fault insurance is meant to promptly cover medical bills and lost wages caused by a crash, not the long-term pain and suffering that may follow, which have merited multi-million dollar judgments and settlements for city crash victims.

The disparate regulations put drivers and passengers at risk, too. Outside the city, the state requires Uber and Lyft cars carrying passengers to have $1.25 million in uninsured and under-insured motorist coverage, which compensates people hit by drivers with little or no car insurance. In the city, the requirement only goes up to $100,000.