NYC Has a Bike-Share System That Works. Why Aren’t We Expanding It?

Instead of extending the usefulness of Citi Bike to more of the city, a two-tiered system could emerge in which neighborhoods outside the current Citi Bike service area get frozen out, left only with access to sparser dockless networks.

This summer, dockless bike-share is coming to NYC in some shape or form. The question is, what will New Yorkers get out of it?

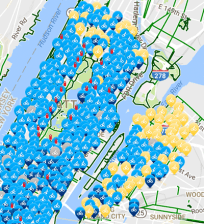

DOT announced last week that 12 companies have expressed interest in participating in the agency’s dockless bike-share pilot. Details are fuzzy, but we know that whichever companies are selected by the city will operate outside the existing Citi Bike service area, where Motivate holds exclusive rights.

The line from City Hall is that the new services could enable New York to extend bike-share to neighborhoods where Citi Bike doesn’t reach. But there are reasons to be skeptical that relying solely on the dockless services is a good or fair way to extend bike-share access.

While dockless bike-share systems are generating lots of trips in Chinese cities, where the bikes are everywhere, the story in America is different so far.

In Seattle, three dockless bike-share companies run a combined fleet of more than 9,000 bikes. While precise figures aren’t available, the bikes appear not to get much use — less than one trip per bike each day, compared to an average of about five daily trips per bike for Citi Bike. The companies are also hesitant to expand much more because they don’t want to hire more people to maintain their bikes, Seattle DOT’s bike-share director told the Seattle Times.

In DC, which invited dockless bike-share companies to launch in limited volumes last fall, usage per bike is less than one-third the level of the station-based Capital Bikeshare, according to data collected by Transit, a trip planner for mobile devices. It’s not an apples-to-apples comparison, however, since the dockless services are much smaller than CaBi.

Usage data from Dallas, which has the largest combined dockless bike-share fleet in the nation, is still unavailable.

Typically offering trips for $1 per ride, the dockless services, buoyed by venture capital, can undercut the upfront cost of Citi Bike subscriptions (though a $169 annual Citi Bike pass is a better value per trip for anyone who uses it four times a week). They can also be deposited anywhere within the designated service area, unlike Citi Bikes, which must be parked at open docks.

Finding a working dockless bike to begin your trip can get tricky though. Like station-based bike-share, if the system isn’t rebalanced, large areas can turn into bike deserts. Observers in DC and Seattle also found a significant rate of major defects, with 12 percent of the bikes diagnosed with problems like faulty brakes or busted lights.

TransitCenter advocacy director Jon Orcutt led the development of Citi Bike at NYC DOT during the Bloomberg administration. There are good reasons that Citi Bike is used more intensely than dockless systems, he said.

“The Citi Bike reliability factor, in terms of location and a strong working app ecosystem — you’re just going to get more rides from that,” he said. “[Dockless bike-share] is not a high-usage kind of system, unless you’re really going to inundate the city with them.”

Motivate’s bikes are also well-constructed and regularly maintained. Many of the dockless bike-share companies can’t say the same about their bikes.

There’s certainly an advantage to dockless technology and the flexibility it provides, both for riders who don’t need to find a dock at the end of a trip, and for operators who can avoid the expense of building stations. The ideal would be to combine dockless capability with Citi Bike’s existing network of stations.

“That would be a game changer, because then it could interact with the docked system,” said Orcutt. “You could extend the benefits of one network to everybody.”

Motivate is one of the 12 companies that responded to DOT’s request and is expected to offer its own dockless service as part of the pilot. In the meantime, however, momentum has been sapped from the continued expansion of Citi Bike, depriving neighborhoods of access to a system that’s already proven its utility in the city.

Instead of extending the usefulness of Citi Bike to more of the city, a two-tiered system could emerge in which neighborhoods outside the current Citi Bike service area get frozen out, left with access to sparser dockless networks that don’t connect to central neighborhoods.

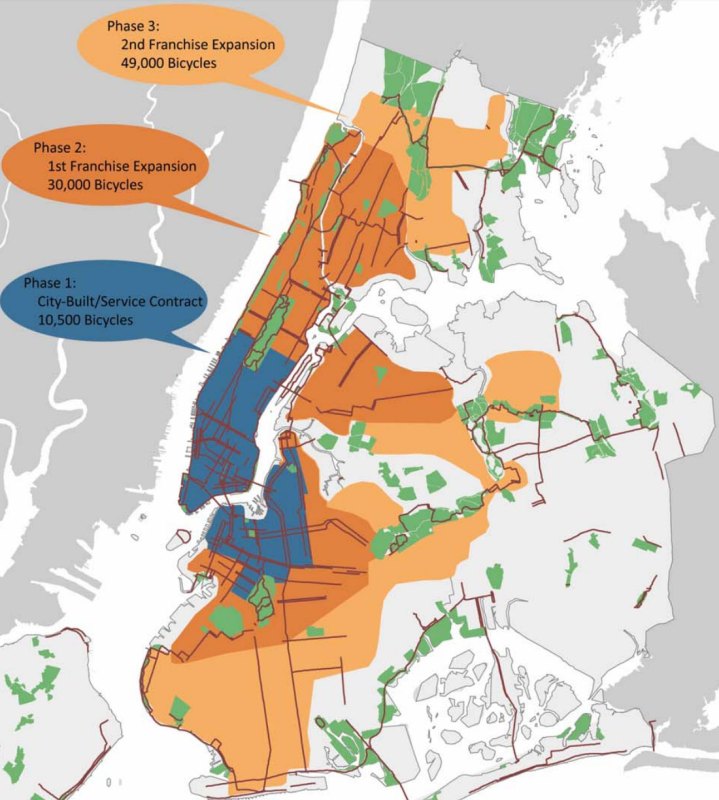

Motivate had been in talks with City Hall to expand its fleet by another 50 percent, with the service area reaching parts of the Bronx. But Mayor de Blasio did not want the next round of bike-share expansion to replace on-street parking spaces, according to one source familiar with the negotiations.

Enter the dockless bike-share companies, which don’t come attached to stations that occupy curb space.

The irony is that any bike-share system, dockless or station-based, is bound to stir up crankiness when it debuts in a new place. The introduction of dockless bike-share in U.S. cities hasn’t been immune to griping at all.

As TransAlt Executive Director Paul Steely White told AM New York, “The city can’t opt out of facing that political reality that you still need to reorganize street space to accommodate even dockless bike share.”

It’s valuable for the city to see how dockless bike-share services function here. But experimenting with new options is no excuse to stop expanding the current system, which works very well.