It’s Official: Chicago Parking Privatization a Massive Rip-Off

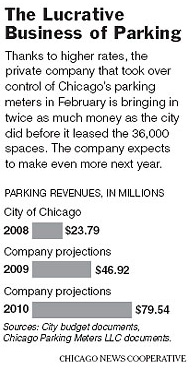

City parking meters are a gold mine, and in Chicago, Morgan Stanley is rolling in parking riches. Secret

company documents leaked to reporters show the company will rake in a 70 percent profit

margin this year from its $1.15 billion, 75-year lease of Chicago’s parking

meters. This profit is on top of the millions Morgan paid to buy new, high-tech

meters. The good times will keep on rolling for investors: In 2010, after another meter

price hike, Morgan expects to make monthly profits of $4.8 million, roughly 55 percent

higher than in 2009.

Graphic: New York Times/Chicago News Cooperative.

Graphic: New York Times/Chicago News Cooperative.Last December, Streetsblog estimated that the Chicago

deal would cost taxpayers "several hundred million to even a billion dollars in

foregone parking revenue." Using the latest Morgan numbers, privatization

expert Roger Skurski told reporters his "conservative estimate"

— Chicago could have earned about $670 million more by holding on to its meters. Back in June, before Morgan’s revenue was known, Chicago’s inspector general estimated the city could have gotten $2 billion in revenue, or $850

million more than it did from Morgan, had it raised rates and kept meter revenue

to itself.

Streetsblog has been following the Chicago parking

privatization closely because it is the poster child for all that can go wrong

with Public Private Partnerships, or PPPs. The basic idea behind a PPP is that

the government leases public transportation infrastructure — say a bridge,

highway, airport, or parking meters — that can generate user fees. In exchange

for the fees, a private investor pays the government a large upfront fee or

assumes the cost of improving the infrastructure. PPPs are popular in Europe, especially at

airports.

Sustainable transportation advocates should care about PPPs for

a number of reasons. First, politicians and bureaucrats are captivated by the

fantasy that PPPs are the ultimate free lunch, generating billions in

transportation investment at no cost to the taxpayer. President Obama’s

euphemism for PPPs is "creative financing." Here in New York, state officials

have repeatedly presented a PPP as the way to raise billions for the

astronomical cost of replacing the Tappan Zee Bridge. This is dangerous thinking. PPPs do inflict a cost, and it’s a big one. Huge amounts of revenue that could be directed to

public transit, or crucial road and bridge repair, are instead going to Wall

Street.

The second concern is that PPPs allow public officials to skew

the public planning and review process and put private profit before public

benefit. A private investor has

tremendous leverage over what gets built if they are the government’s main

financing option. The investor’s goal is

to make money, not to produce the greatest public benefit over many decades.

Despite the latest revelation, Chicago is only

beginning to recognize the inherent problems with privatizations. According to

the Times, Alderman Scott Waguespack introduced

a measure that would require an "independent third-party valuation" of major

asset lease proposals before any future privatization deal is completed. The

legislation would require "a comparison of public retention and private leasing

over the life cycle of the agreement." This could serve as an important safeguard, but so far, the measure only has 12 co-sponsors among the council’s 49 other

members.